We’re pleased to announce we’ve officially launched our 2022 Global Esports and Live Streaming Market Report! This article presents some high-level findings and data from the esports section of the report (don’t worry, the live-streaming article is coming next week!), covering the esports audience and revenue growth, the latest esports industry trends, and more!

Global Esports Fandom Is Continuing to Grow in 2022 and Beyond

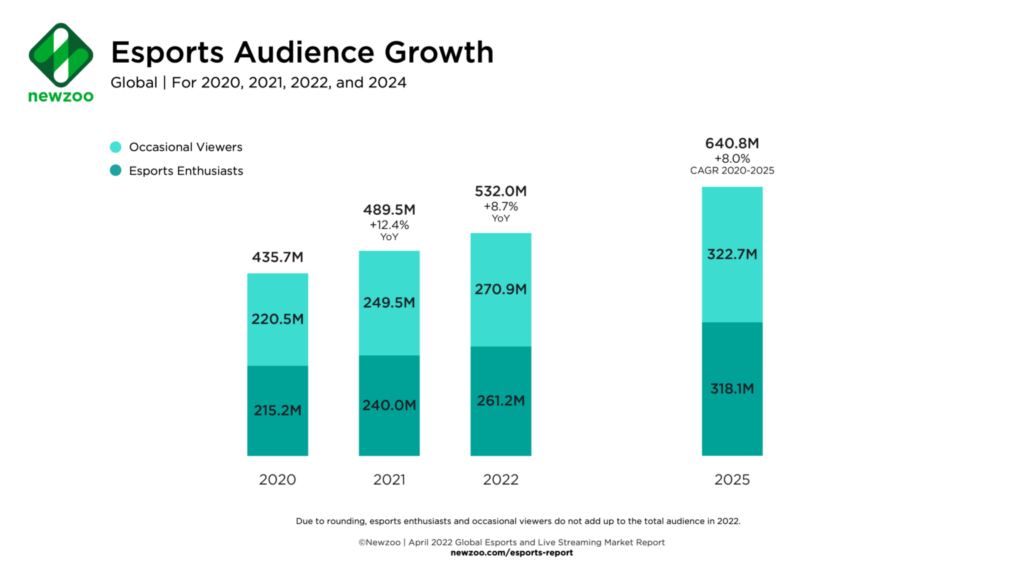

This year is on track to be another impressive year for esports audience growth. In 2022:

- The global esports audience will grow +8.7% year on year to reach 532 million.

- Esports enthusiasts—those who watch esports content more than once a month—will account for just over 261 million.

- Occasional viewers—those who watch esports content but less than once a month—will account for the remaining 271 million.

The main drivers behind esports audience growth are:

- Popular new esports franchises such as Valorant, which build on Riot’s previous successes and experience from League and Legends

- Mobile esports’ expansion with regional leagues like Mobile Legends: Bang Bang and League of Legends: Wild Rift

- The rise of esports in growth markets across Southeast Asia, Latin America, and the Middle East and Africa

As you can see above, the number of esports enthusiasts will grow to 318 million in 2025, with a CAGR of +8.1% (2020-2025). In 2025, the total audience will surpass 640 million.

Like esports year-on-year growth this year, we also attribute the market’s longer-term growth to emerging markets like across Southeast Asia, Latin America, and the Middle East and Africa. Moonton, Tencent, Garena, and other publishers are heavily investing in the competitive side of mobile games in these markets, and they are finding great success. Download this free report for the full details (and data!) on mobile reports.

What’s more, as high-end hardware becomes more available and the internet infrastructure evolves, esports will be more accessible than ever, also contributing to growth.

Esports’s Growing Engagement Results in Rising Revenues

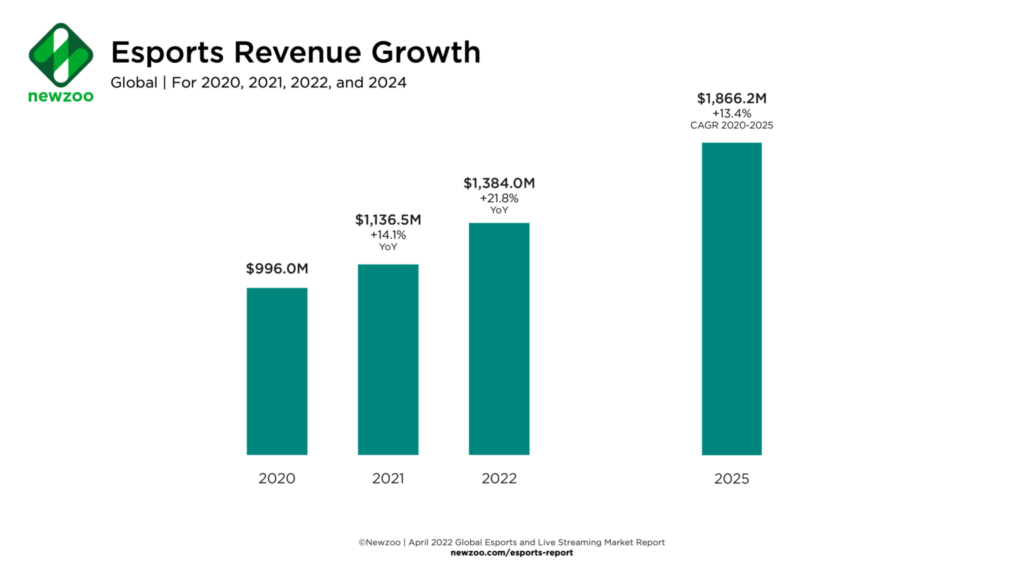

Esports will generate nearly $1.38 billion in revenues globally by the end of 2022. China accounts for nearly a third of worldwide esports revenues.

Revenues from brand partnerships are the foundation on which the esports market was built, so it’s no surprise that sponsorship continues to be esports’ highest-grossing revenue stream, generating $837.3 million in 2022 and accounting for nearly 60% of the entire market.

While sponsorship revenues have certainly expanded esports’ reach and resources—and continue to do so via high-profile partnerships with crypto companies like FTX—relying on one revenue stream is risky for esports organizations.

Luckily, many esports organizations are diversifying their revenue streams away from sponsorship. This diversification ensures that esports revenues will continue to increase and makes the industry more resilient to changes in the sponsorship landscape. Direct-to-fan monetization, digital merch and NFTs, loyalty schemes, traditional investment, and educational programs are just a few ways esports organizations are diversifying their revenue streams..

While more mature esports markets like China and the U.S. are most commonly exploring this diversification—and contribute most to absolute revenues—emerging markets will contribute most to growth. Localized content is the backbone of this growth.

Preferences among one region’s esports fans are often significantly different from another’s. The esports organizations and brands that truly understand these differences are more likely to enjoy higher engagement and better returns on their investments.

Regional Asia-Pacific esports revenues will grow by +17% year on year to reach $590.2 million in 2022, accounting for nearly 42% of global revenues.

Longer-Term Esports Revenue Growth is en Route

Even more growth is coming to esports globally, also thanks to diversifying esports revenue streams, emerging markets, and mobile esports:

The full version of the report shows that digital and streaming are the two fastest-growing revenue streams for esports, with 2020-2025 CAGRs of +27.2% and +24.8%, respectively. Growing awareness around digital assets and NFTs will likely boost investment and fan interest in acquiring in-game items of esports IP. Blockchain gaming is a trending topic in the gaming market, the path to mainstream esports, but there are roadblocks preventing blockchain titles from breaking into esports, including pay-to-win aspects, fear of getting scammed, and the high price of admission.

However, there are also plenty of opportunities, and the blockchain offers some exciting ways to engage fans, which we dive into in the free report.

In the end, esports boils down to one that all-important factor: engagement. The seeds that publishers, brands, and esports organizations are now planting are essential to consider for the future of both markets.

For all things esports and live streaming, download this free report, which covers everything in this article and more. And be sure to look out for our upcoming article focused on the games live-streaming market.

Other Article: