Thomas Alomes, SVP, head of market insights at Sports Tech World Series, outlines some of the key findings from a new report on the esports and gaming industry.

Sports Tech World Series (STWS) has developed a new report, sponsored by Tipalti and BIG, revealing the state of the esports, gaming and streaming markets globally.

The report includes insights from interviews with 31 esports and gaming industry leaders on the greatest challenge currently facing the sector; overhyped and overblown trends from the last 18 months; and emerging developments driving growth across the industry. These industry experts also identified 20 startup and scaleup companies that are impressing with their innovation.

In this article, STWS senior vice president and head of market insights Thomas Alomes picks out some of the key findings from the report.

Esports needs to diversify revenue

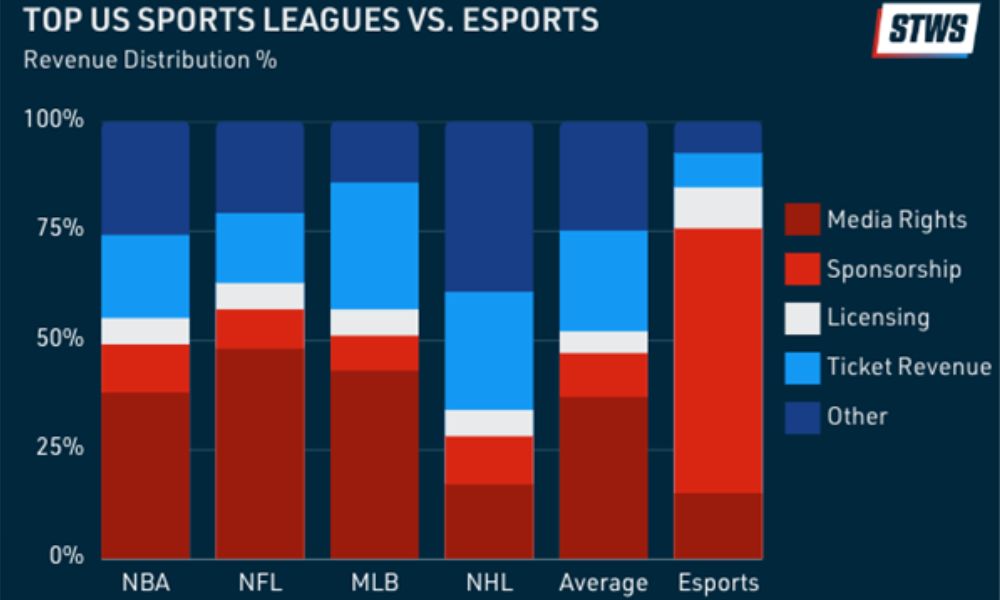

The report highlights the challenges faced by professional esports teams in diversifying revenue away from sponsorship in pursuit of sustainable business models, with the vast majority of teams not achieving profitability and heavily reliant on external investment.

Sponsorship accounts for over 60 per cent of total revenues for esports teams. Sponsorship deals are typically on shorter terms than decade-long media rights deals, giving esports less long-term stability over guaranteed revenues when compared to traditional sports teams and leagues.

However, esports is unlikely to be able to replicate the success of traditional sports’ media rights deals due to a number of factors, including issues with IP ownership.

Esports leveraging the creator economy

As esports becomes more ingrained in popular culture, the business models that underpin its growth and sustainable success are beginning to evolve. It is expected esports teams will shift from being competitive teams in the traditional sporting model to agencies and brand consultancies created to connect brands and communities with their athletes and talent as creators.

The emergence of the creator economy presents a huge opportunity for esports to monetise the direct connection they have built with their audience. The majority of these teams already possess the skills and assets required to provide these services but it is a question of how quickly they can evolve to take advantage of new opportunities. The products, services and technology underpinning the creator economy also continues to grow and mature to meet these needs.

Esports team valuations continue to rise

Despite structural issues with revenue diversification, the valuations of top esports teams continued to rise in 2022.

The ten most valuable esports companies are worth a combined $3.5 billion, up 46 per cent from December 2020. In July 2022, Faze Clan became the first esports and gaming lifestyle brand listed on the Nasdaq through a merger with a special purpose acquisition company (SPAC), trading under the ticker symbol FAZE. Following its listing, Faze Clan leapfrogged from a previous valuation of US$400 million to US$725 million, making it the most valuable esports team globally.

Faze Clan typifies both the potential growth and also the struggles of esports teams to become sustainable, diversified businesses. Sponsorships accounted for nearly 50 per cent of Faze Clan’s total revenues in 2021 and it posted a net loss of US$9.3 million in the second quarter of 2022.

Faze Clan are the world’s most valuable esports company with a valuation of US$725 million

Post-pandemic correction – gaming and live streaming

The gaming market is going through an inevitable post-pandemic correction with decreased sales. US consumer spending on video game hardware, content and accessories is projected to reach US$55.5 billion in 2022, a decline of 8.7 per cent when compared to 2021. Gaming is once again competing for consumer attention and spending against different entertainment options, including live events. This decline has also been exacerbated by higher prices in everyday spending categories such as food and fuel, combined with economic uncertainty restricting discretionary spending.

Although gaming sales fell from 2021 highs, 2022 has been a record year for M&A activity in gaming with more than US$107 billion in total deal value. This includes Microsoft’s acquisition of Activision Blizzard for US$68.7 billion. If that deal is approved by market regulators and completed as planned by financial year 2023, it will make Microsoft the world’s second-biggest gaming company by revenue, behind China’s Tencent Holdings and ahead of Japan’s Sony Group. Through its Xbox division, Microsoft is already one of the largest game console manufacturers globally and the proposed acquisition would be the largest in Microsoft’s history, more than double the US$29 billion paid for LinkedIn in 2016.

Optimistic views welcome this market consolidation with the expectation it will lead to greater innovation and direct competition from the major players. However, antitrust enforcers across the globe are lining up to review the deal, including the UK’s Competition and Markets Authority which opened an investigation to consider whether the deal may harm competition ‘through higher prices, lower quality, or reduced choice’.

Microsoft’s planned acquisition of Activision Blizzard will make it the second-biggest gaming company by revenue

Live streaming also saw post-pandemic market corrections. The global Covid-19 pandemic period in 2020 and 2021 saw unprecedented growth across live streaming services but also a corresponding decline into 2022 as the world emerged from restrictions. Facebook Gaming has seen the largest decline in viewership with YouTube Gaming flattening and Twitch trending back towards 2021 highs. Currently, Twitch is the dominant live streaming platform with 6.1 billion live streaming hours watched in the first quarter of 2022 (76 per cent of the total), followed by 1.1 billion hours on YouTube Gaming (14 per cent) and 800 million hours on Facebook Gaming (ten per cent).

Blockchain integrations have been overhyped, but esports and gaming are at the vanguard of realising the future of the metaverse

The overwhelming majority of experts interviewed identified that blockchain-powered initiatives, including the integration of cryptocurrencies and non-fungible tokens (NFTs) into gaming, had failed to live up to the hype.

However, the experts are bullish on the overall impact of Web 3.0 and the metaverse for the industry going forward, with investment and M&A activity increasing in this space. There was US$2.3 billion raised for Web 3.0-related startups in the first half of 2022, including metaverse technology specialist Infinite Reality completing a US$470 million acquisition of esports and entertainment company ReKTGlobal in July, with a post-close valuation of US$2.47 billion.

Although Web 3.0 is still a very immature market – and we will continue to see high-profile failures as the market grows – gaming and esports can combine the underpinning technology, such as game engines and VR, with a digitally native fanbase accustomed to playing, transacting and interacting in fully virtual environments.

As always, watch this space, but gaming and esports present the most tangible experience of an immersive, open platform metaverse (or metaverses) that we have seen so far and could hold the keys to its future.

Other article:

The Rise of Esports betting in Canada: Opportunities and Challenges