Success checklist for non-endemic brands entering the video gaming and esports sector

Business opportunities in the realm of digital competition

Surging video gaming audiences worldwide are enticing external companies to venture inside the esports industry. Fabled riches could await those who can forge a relationship with an audience that is younger, more highly educated, technically literate, and with higher incomes than the general population but there are also dangers.

Some firms are entering the ecosystem for the first time, while others are deepening existing partnerships. In both cases, these ‘non-endemic’ brands (firms whose competencies lie in unrelated industries) are hoping to connect with the thriving fan base to unlock growth for their businesses. Mainstream soft drink companies, luxury car manufacturers, and computer firms are sponsoring esports to target a young, affluent demographic. Traditional broadcasters are screening esports to reach an audience that increasingly rejects linear TV. This is what makes video gaming and esports a premier channel for brands.

The approaches taken by such companies are as diverse as the sector. They include classic advertisement and sponsoring, through creative content generation and product partnerships, to equity investments in endemic brands or the development of new, company-owned structures. There are few limitations in the configuration of the engagement mix. Yet, the wealth on offer may not be as readily attainable as it appears. To be successful, firms must follow through with an authentic and sincere commitment to video gaming and esports. They also must demonstrate creativity in terms of fan engagement. This is neither straightforward nor easy. But if they follow this path, they can win the appreciation of a young, open-minded audience and build a strong relationship with them.

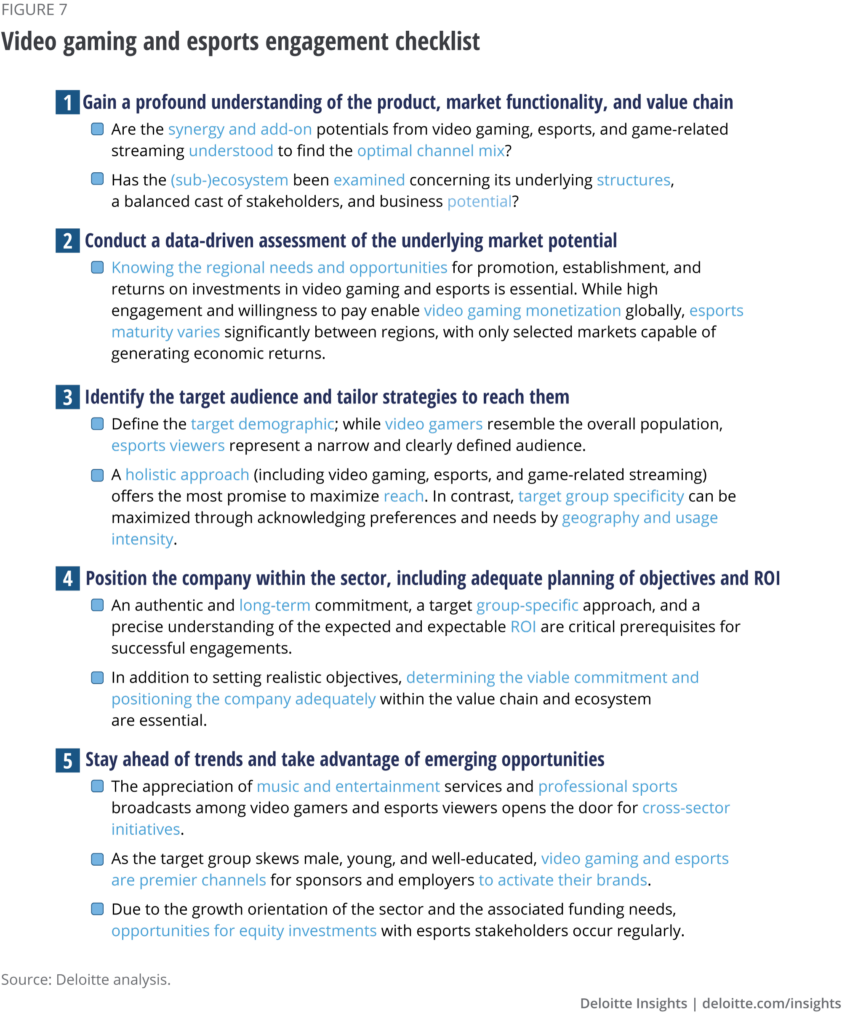

The engagement of non-endemic brands should align with their identity, goals, and capacities. To help orientate them, Deloitte has created a Checklist for engaging in video gaming and esports (figures 1 and 7). The elaboration and continuous adaptation of these activities should guide the formulation and execution of a sector strategy. This will support a successful video gaming and esports engagement, maximizing the benefits for the new partner and the ecosystem stakeholders.

Step one: understanding the concept

The line between video gaming and esports is blurry. Both industry sub-sections have a product and service focus on electronic games, and the value chains are deeply intertwined. Understandably, the terms are often used interchangeably, but there are differences.

Video gaming is actively consuming any video game regardless of the platform or means. This can be playing Candy Crush on your phone while waiting at a bus stop or throwing digital grenades at your friends in a competitively friendly online game of Counterstrike Global Offensive (CS:GO). Esports is professional video gaming. Competitive video gaming has been around since the 1970s, but when the internet became more widely available, it began attracting global audiences and vast prize pools. Esports is more passively consumed by the audience.

Video game-related streaming bridges the gap between active video gaming and passive esports consumption as players and viewers have access to the streaming platform. This way, streaming services help promote the consumption of video gaming and esports overall.

The development of video games and in-game content is the value creation of products and services across the sub-sectors. In esports, the organization and hosting of official competitions contribute significantly to value creation.

For example, the ESL Pro Tour, with its Intel Extreme Masters tournaments, attracts a broad audience that reflects the visibility and attractivity of esports. PGA and BLAST organize similar competitions. In-game-related additional value is created through content creation by streamers and influencers distributing information and providing visibility to video gaming and esports.

Value delivery occurs when content is distributed on broadcasting platforms. Additionally, in video gaming, distributors (like retailers of physical products and digital marketplaces) are intermediates who deliver games and related items to the end customer.

The value creation and delivery phases are essential for brands targeting video gaming and esports in their marketing and engagement mix. For example, brands can leverage sponsorship to engage with specific game titles in streams and at esports events. This enables brands to communicate their brand and values to fans during value consumption.

Together video gaming and esports will generate an estimated $184 billion in 2024, a drop of 4.3 percent year on year, after two exceptional years when the world reached for its controllers during the lockdown. The industry is projected to be worth $211 billion by 2025.

The revenue of esports is expected to hit more than $1.38 billion in 2022, mainly through advertising, co-streaming rights, and sponsorship. That is only $5.30 per serious fan. But as esports brands morph into lifestyle brands, media rights, merchandising, and loyalty programs are all expected to grow significantly.

Stakeholders can be involved in video gaming, esports, or even both sub-sectors. Similarly, monetization approaches can encompass both sub-sectors providing synergy potential for brands that actively pursue this path (figure 2).

Esports teams and league/event stakeholders are striving to diversify their businesses and improve their revenue mix. The esports teams surveyed for this report indicate that, on average, about two-thirds (65%) of revenue stems from core esports activities, such as sponsorship sales (37%) and prize money (15%).

In turn, 31% of the revenue of esports teams stems from adjacent areas such as content creation and influencer marketing (14%), consulting or agency services (6%), and activities unrelated to video gaming and esports (4%). A similar picture emerges for esports leagues and event hosts (on average, 63% of revenue from core esports-related activities), whose add-on activities extend mainly to the organization of amateur video gaming events and the cross-sectoral use of existing capacities in media production.

Step two: Understand that audience size and engagement define market potential

Like the sports and entertainment industry, video gaming, esports, and game-related streaming thrive on the size and engagement of their audiences. The strength of the fan base denotes end-user demand and provides ecosystem stakeholders with their business cases.

While all three areas have remarkable reach among the global population (55% of people survey played a video game in the last six months, 27% watched esports content and 12% followed a game-related stream), the dynamics differ:

- Active video game consumption is deeply embedded in society (86% of people surveyed know at least one video game; 42% play at least once a week). Esports is growing in public awareness (88% know the term 'esports' vs. 76% in 2020) but has yet to find a niche in everyday life. Only 37% surveyed can define ‘esports,’ and a mere 14% watch esports weekly.

- Video gaming offers a solid basis for long-term economic development. While esports is experiencing growing popularity, primarily driven by an abundant supply of relevant free content, it struggles to convert a broad audience into regular paying customers. Some 34% of those surveyed have played and spent money in the past six months on video games vs. 15% on esports.

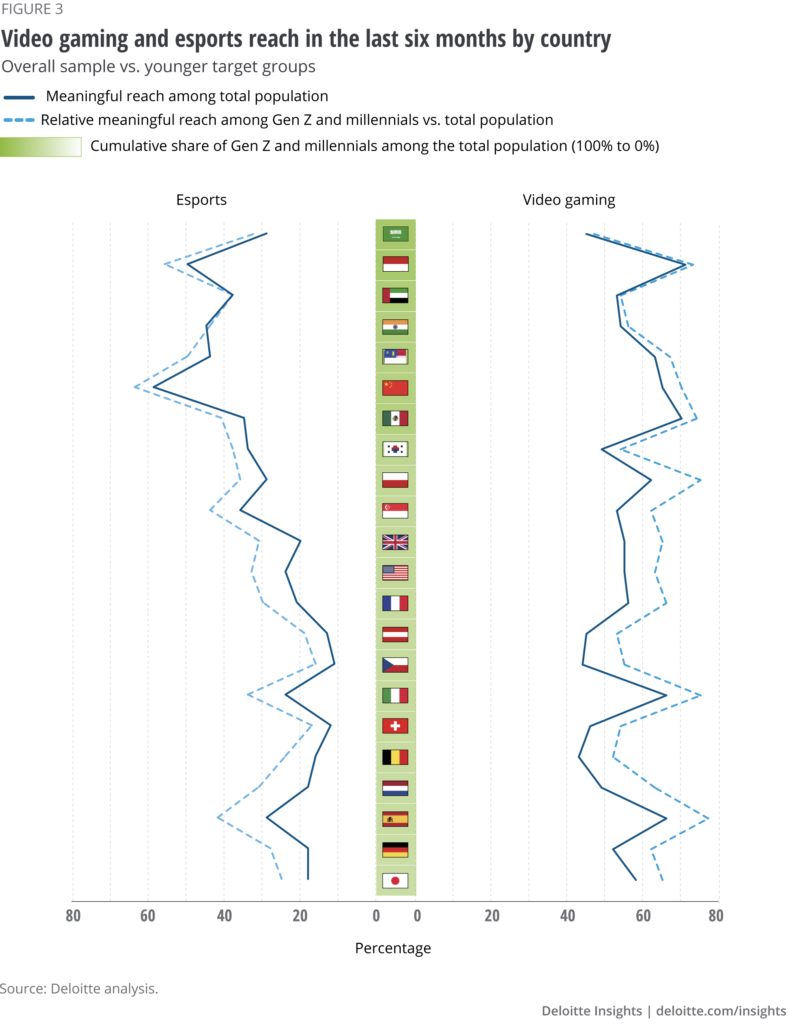

- A market comparison reveals that the video gaming audience closely adheres to the overall age demographic of the general population. Gen Z and Millennials predominantly drive esports consumption (figure 3, right-hand side). As a result, video gaming has a penetration rate above 40% across markets due to its presence in all demographics. In contrast, esports penetration rates are overdeveloped in markets with younger demographics (figure 3, left-hand side).

Step three: Craft a tailor-made approach as there is no ‘one’ esports consumer

Video gaming and esports target groups skew towards males (53% and 58%, respectively, compared to the overall sample). Households where this target group lives generate above-average net incomes (€3,620 and €4,089, respectively, vs. €3,544). Regarding age, video gamers track more closely to the demographics of the overall population than esports fans do.

This makes esports an excellent channel to reach a narrower, more specific audience, whereas video gaming is a means of communication with the general public. Furthermore, 39% of video gamers and 80% of esports viewers do not concentrate their activities on one area but combine video gaming and esports, creating an overlap between active and passive users. Restricting activities to one sub-sector would exclude much of the addressable market.

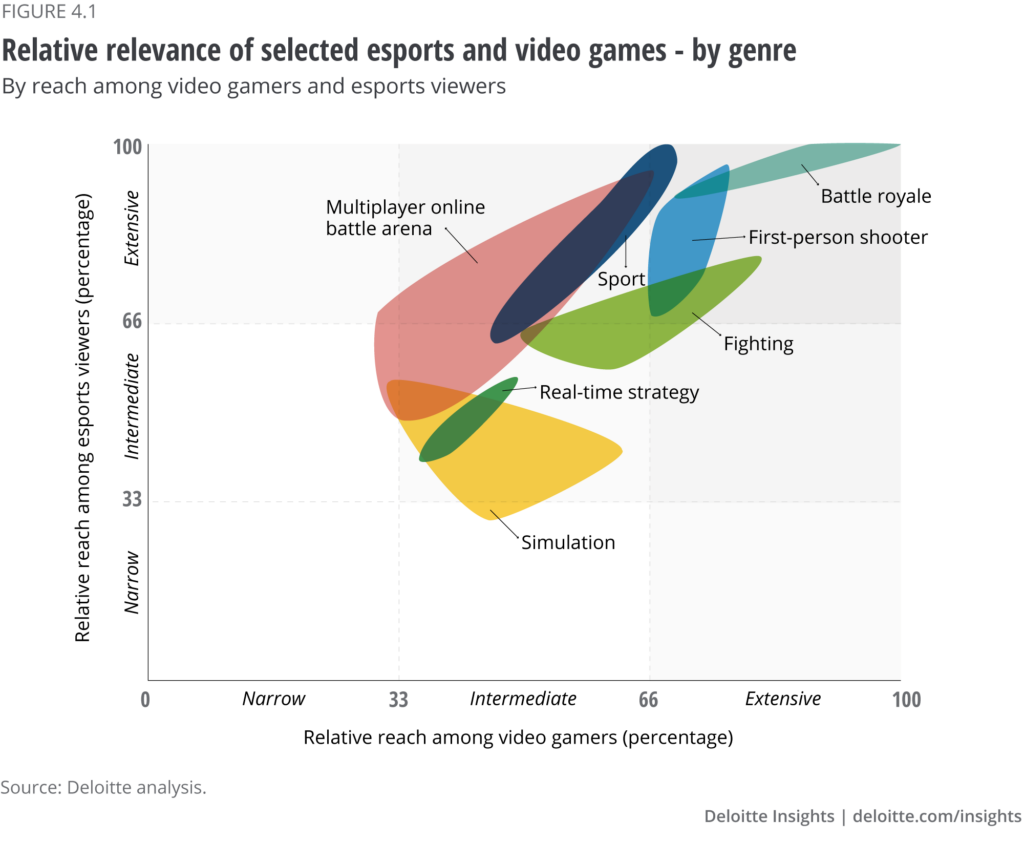

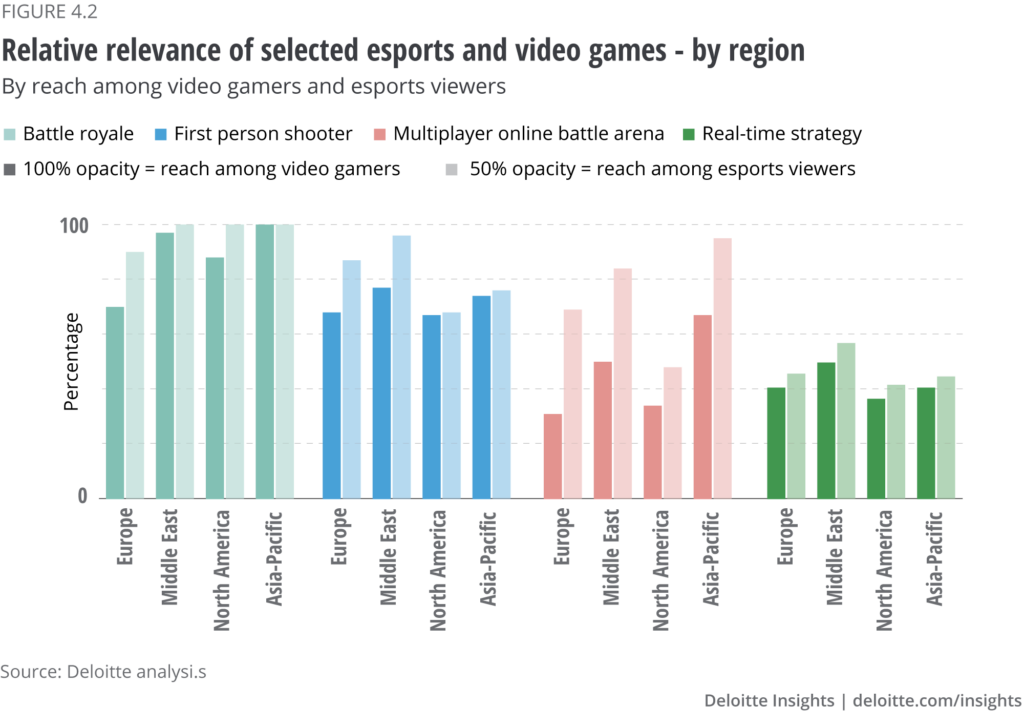

A further differentiation for a target group-specific approach is the individual video gaming genres, which offer different reach among video gamers and esports viewers. Regional preferences also play a significant role in determining the size of the audience per genre (figure 4B). Furthermore, preferences regarding game titles played, and esports watched change with increasing consumption intensity.

When these criteria are applied to relevant video game genres, Battle Royale and First-Person Shooters (FPS) seem to hold the most significant activation potential for non-endemic companies. Both genres are relevant in video gaming and esports and appeal to occasional and regular consumers around the globe because they are simultaneously accessible and profound.

Sports and Racing have high acceptance, especially among occasional users, but there are significant differences between regions in terms of popularity. For example, while the genre ‘Sports’ belongs to the games with the widest reach among esports viewers and video gamers in Europe, it attains less reach among both groups in the Asia-specific region. The Multiplayer Online Battle Arena (MOBA) and Fighting genres have avid fan communities who regularly view events.

Step four: Setting realistic objectives is as important as adequate positioning in the sector

Given the options, non-endemic companies must have a realistic understanding of their expected (and expectable) return on investment. In particular, they must understand that addressing the video gaming and esports audience authentically and accurately will be critical in determining success. Their assessments should include understanding their viable commitment, the target group, and the most promising positioning within the sector.

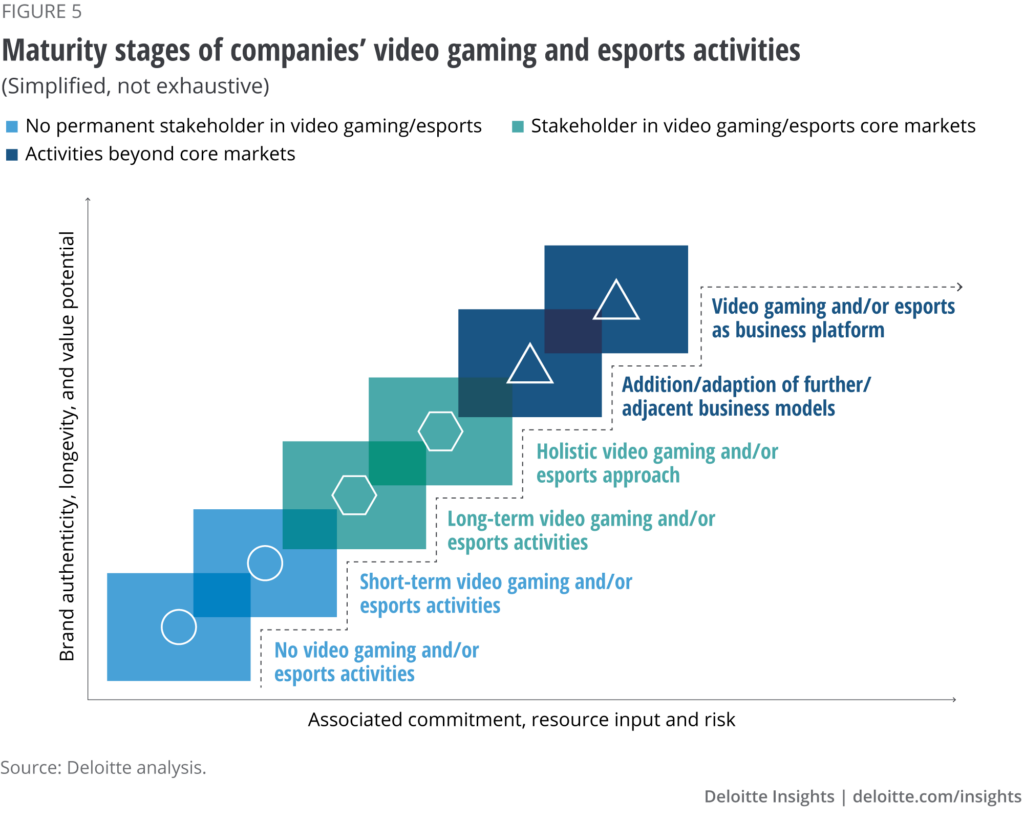

Making a long-term commitment and diversifying activities will increase the chances that their impact will extend well beyond one-off effects. Yet, establishing the company as a permanent player in the sector implies higher business risks than short-term activations, which do not require a long-term commitment of company resources (figure 5).

As growing segments of the audience move beyond considering video gaming and esports as entertainment and toward creating a lifestyle around them, there is potential to create business models that extend beyond the original sector borders of both esports and video gaming. This could unlock additional revenue potential.

Given this, cross-industry products and service offerings are increasingly gaining relevance. Driven by the prospects of unlocking additional revenue potential, increasing numbers of stakeholders (such as publishers, league and tournament organizers, and media platforms) are expanding their business models beyond core video gaming and esports activities.

To achieve this, they are leveraging their brand power and existing, conferrable company capabilities to create cross-sector products. These include, for example, TV shows that feature video game characters and stories, and video game and esports branded fashion. These have been watched or worn by 20% and 11% of respondents, respectively.

Step five: Explore sector trends driving partnerships with non-endemic companies

The esports sector is young, dynamic, and consumer-oriented. There are increasing efforts to define its structural and regulatory framework. The sector needs to keep up with technological and societal trends, as missing decisive developments implies a risk of being ‘left behind.’ Additionally, as the sector largely depends on single revenue streams or individual clients and events, upcoming trends may hold new monetization opportunities.

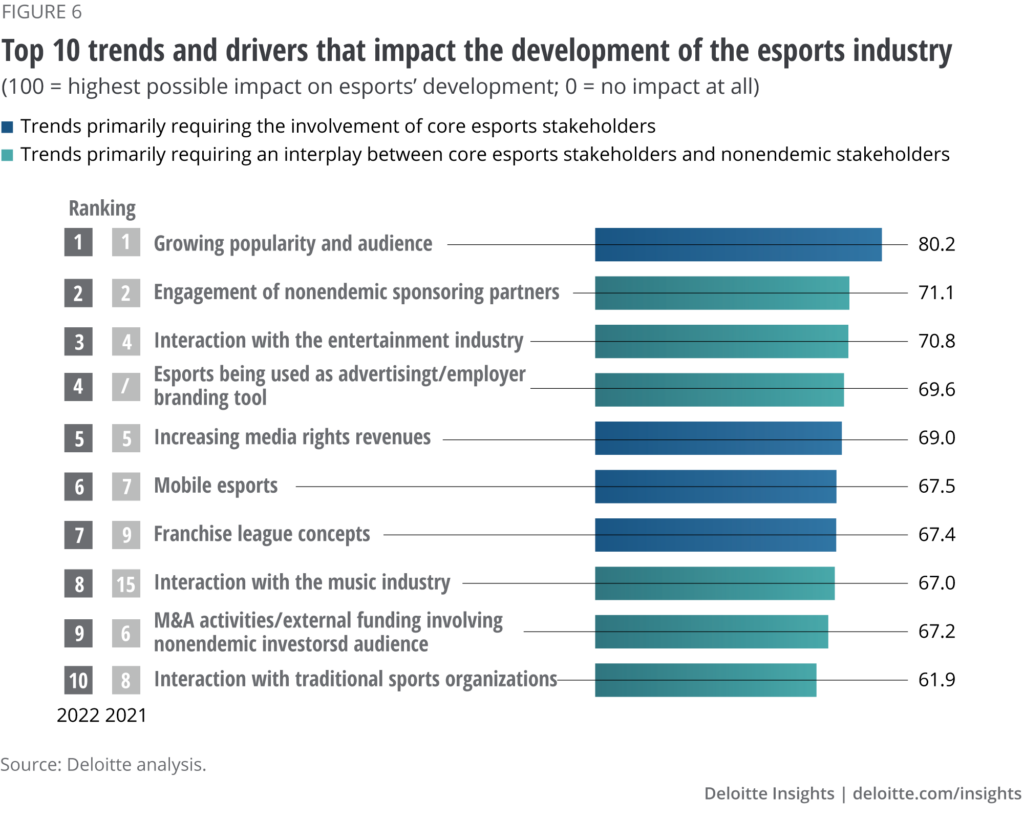

There are six developments involving an interplay between esports and non-endemic stakeholders interesting for firms entering the sector. According to market experts, these developments rank among the Top Ten most important trends and drivers impacting the sector (figure 6).

In this regard, there is a high potential for mutual benefit from interaction between the music and entertainment sectors and video gaming and esports. This is driven by the natural proximity between the products and a substantial target group overlap. Among the esports audience, 86% and 83%, respectively, identify as music and movie/TV show fans, compared to 75% and 69% in the overall survey. The same applies to traditional sports organizations, as more than 50% of esports viewers also regularly follow traditional sports events, compared to 34% in the overall survey.

Furthermore, the esports audience is a sought-after target group in end-customer marketing and the ‘war for talent’ in the labour market. For example, 17% of esports viewers have their professional background in ‘STEM’ (vs. 11% in the overall sample), and 65% say they are open to a job change (vs. 47%), making esports a promising advertising and employer branding tool.

Consequently, a growing number of non-endemic companies are attracted to the sector, thus encountering esports companies looking to add capital, revenue, know-how, and networks to their organizations. Therefore, equity investments from non-endemic companies have become increasingly popular in recent years, fuelling growth in ecosystem areas.

Step six: Complete the checklist

The first essential step towards a prosperous video gaming and esports engagement by a non-endemic company is a thorough assessment of the opportunities and potential headwinds in the sector. The company must also identify its inherent capabilities and restrictions. The video gaming consumer base is already broad and mature, and the esports product and audience have shown remarkable growth in recent years. The impact of COVID-19-related restrictions contributed to this growth in audience numbers and engagement. Despite a recent decline in audience numbers after the majority of COVID-19-related restrictions were lifted, total audience numbers still experienced growth when comparing recent with pre-COVID-19 numbers.

However, questions remain regarding the ability of esports to continuously engage the audience and convert viewers into paying customers. Structural development, building reach, and establishing long-term relationships with esports fans are critical steps in the medium term rather than generating a financial return on investment.

Non-endemic companies that have done their homework can realistically assess their potential in video gaming and esports and will be well-equipped to choose and implement the most suitable approach. Although each initial situation must be evaluated individually, respecting the essential strategic cornerstones for a video and esports engagement will help to create ultimate success (figure 7.)

Other article: